osceola county property tax calculator

The 2018 United States Supreme Court decision in South Dakota v. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property.

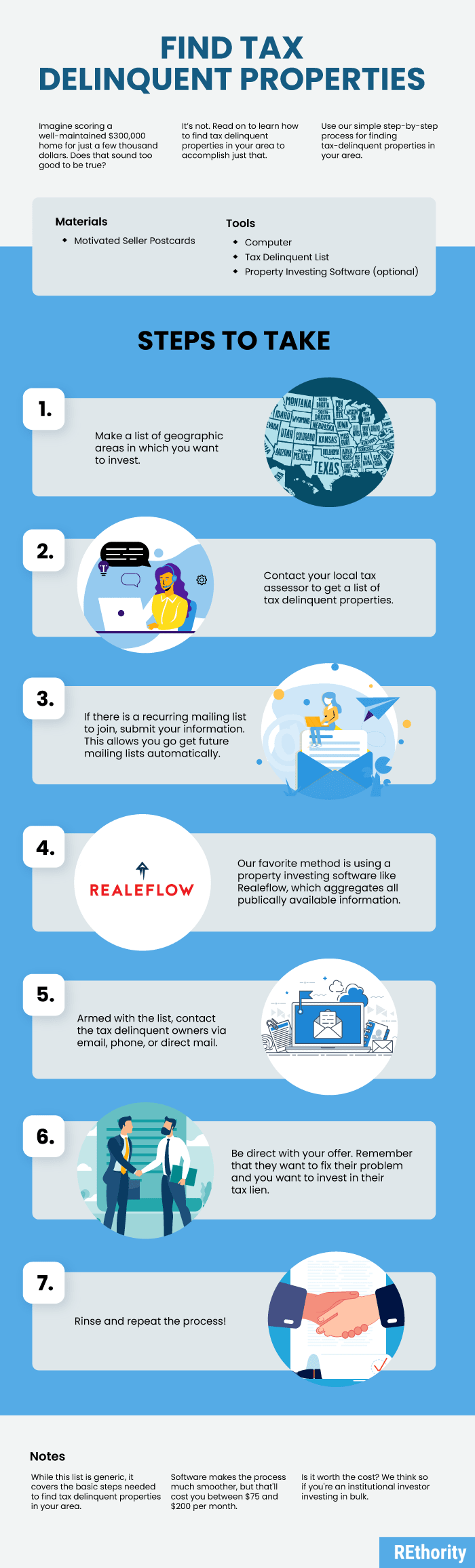

How To Find Tax Delinquent Properties In Your Area Rethority

Osceola County Florida Property Search.

. No walk-ins will be accepted for driving skills test. Choose RK Mortgage Group for your new mortgage. Osceola County Florida Mortgage Calculator.

Osceola County Contact Info. Osceola County Courthouse 2 Courthouse Square Kissimmee Florida 34741 Contact Information. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value.

Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523. For more information go to the Tax RollMillages link on the homepage. Scarborough CFA CCF MCF Osceola County Property Appraiser Tax Estimator.

Effective March 30 2015 Class E Driving Skills Test offered at the Main Office of the Osceola County Tax Collector by appointment only. Please contact the Impact and Mobility Fee Office at. The information provided above regarding approximate insurance approximate taxes and the approximate total monthly payment collectively referred to as approximate loan cost illustration are only.

It also applies to structural additions to mobile homes. 407-742-3995 Driver License Tag FAX. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

For more details about taxes in Osceola County or to compare property tax rates across Iowa see the Osceola County property tax page. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Please fill in at least one field.

Osceola County impact fees are assessed on new developments to provide funding for the County to create improvements needed to serve that developments users. 407-742-3500 Send Feedback Hours. 8am - 5pm Monday through Friday excluding holidays if you are making a payment you must receive a wait number by 430pm The Recording Department stops recording promptly at 430PM.

The median property tax on a 19920000 house is 209160 in the United States. How can we improve this page. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill.

The Tax Collectors Office provides the following services. JANUARY 15 2015 - PHISHING. The Florida state sales tax rate is currently.

Visit their website for more information. The County Treasurer is the custodian of the Countys money. Reed City MI 49677.

Therefore the countys average effective property tax rate is 086. Osceola Tax Collector Website. The easiest way to file your tourist tax returns online.

Actual property tax assessments depend on a number of variables. 712 754 2241 Phone 712 754 3782 Fax Get directions to the county offices. The taxes on a home worth.

1 Courthouse Square Suite 1400 Kissimmee FL 34741. Has impacted many state nexus laws and sales tax collection requirements. To review the rules in Florida visit our state.

Osceola County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. OSCEOLA COUNTY TAX COLLECTOR. Irlo Bronson Memorial Hwy.

Osceola County collects on average 095 of a propertys assessed fair market value as property tax. Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744. An annual assessment is included in your property tax bill.

Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes. 2505 E Irlo Bronson Memorial Highway. These are deducted from the assessed value to give the propertys taxable value.

Michigan Property Tax Calculator. The Osceola County sales tax rate is. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241.

Ottawa County has property tax rates below the state average of 145. The countys average effective property tax rate comes in at 086. Treasurers Office responsibilities include.

More specifically the countys average effective tax rate is 138. The estimated tax range reflects the lowest to highest total millages for the taxing authority selected. Present this offer when you apply for a mortgage.

If purchasing new property within Florida taxes are estimated using a 20 mill tax rate. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Learn all about Osceola County real estate tax.

Osceola County Property Appraiser. Search all services we offer. We use a Market Value range of 875 to 1125 of the purchase price you enter.

Property taxes in Brevard County are somewhat lower than state and national averages. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Osceola County. This is the total of state and county sales tax rates.

Free Credit Report Offers Extended Complaints Have Increased Florida Realtors In 2021 Credit Score Check Credit Score Better Credit Score

Osceola County Clerk Of The Circuit Court

Florida Dept Of Revenue Property Tax Cofficial

Osceola County Clerk Of The Circuit Court

Osceola County Clerk Of The Circuit Court

Michigan Property Tax H R Block

Indiana Property Tax Calculator Smartasset

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Davenport Fl Land For Sale Real Estate Realtor Com

Osceola County Clerk Of The Circuit Court

2022 Best Places To Raise A Family In Osceola County Fl Niche

How To Find Tax Delinquent Properties In Your Area Rethority